Everything You Need To Know About Business Interruption Insurance

11/8/2020 (Permalink)

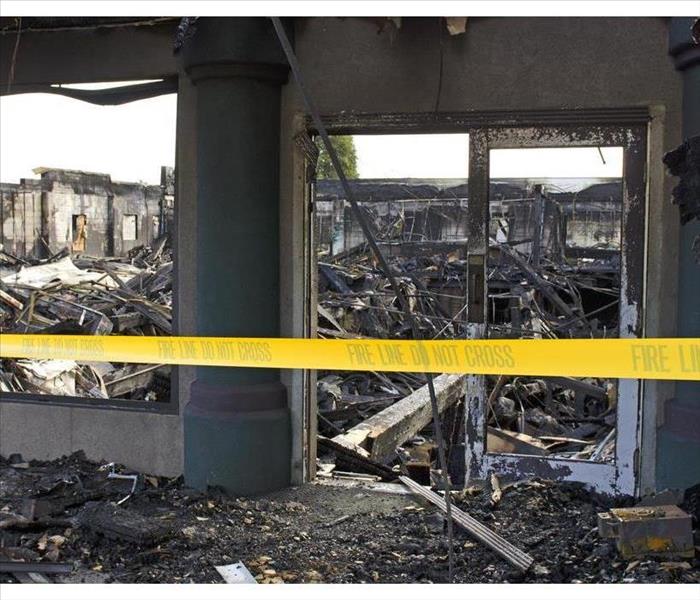

Learn More About How This Plan Can Benefit You After A Business Fire

When fire affects your Woodbourne, PA, business, you will need comprehensive insurance coverage. Business interruption is one of the most common additions you might see. While it initially seems like commercial or incident-specific insurance, it has major differences that determine the recovery efforts.

Areas Covered by Insurance

Stopping operations after a fire causes a stop on profits until recovery and reopening. An interruption plan accounts for this loss. Additionally, it covers charges that emerge during this period, including:

- Lease or rent bills

- Moving costs

- Continuing utilities (electricity, water, etc.)

- Taxes

- Employee payroll

Notice that it only covers money potentially lost from business shutdown and regular monthly costs. Other factors such as fire damage repair are covered by traditional commercial insurance policy.

Coverage Length

Another feature that differentiates business interruption coverage is the time limit. This type of plan takes between 48 to 72 hours to go into effect after the claim. The length depends entirely on how long the recovery of your business takes. Once the fire cleaning and repairing process is complete, your business can resume operations and you will no longer need this insurance. The coverage can last for several days, weeks and even months depending on the severity and extent of the damage.

Interruption Preparation

Even though interruption protection ensures your organization survives this incident, you can always minimize both the overall damage and the pause length with the right preparations. Besides the addition of this protection to your insurance strategy, you can thoroughly inspect the property and fix any potential issues that can escalate after a business fire. Work with a remediation company to create an emergency plan that is specifically designed for your commercial building.

While regular commercial property insurance can help you cover the costs of repairing fire damage, it does not include other aspects like profit loss and regular expenses. Add business interruption to the existing plan to keep your establishment strong during this time.

24/7 Emergency Service

24/7 Emergency Service